The 5-Minute Rule for San Diego Home Insurance

The 5-Minute Rule for San Diego Home Insurance

Blog Article

Secure Your Comfort With Reliable Home Insurance Coverage Policies

Why Home Insurance Coverage Is Necessary

The value of home insurance lies in its capability to supply financial protection and comfort to homeowners when faced with unforeseen occasions. Home insurance functions as a safeguard, providing insurance coverage for damages to the physical framework of your house, individual items, and liability for mishaps that might take place on the property. In case of natural disasters such as fires, floods, or earthquakes, having a comprehensive home insurance plan can aid home owners recoup and reconstruct without encountering substantial economic problems.

Furthermore, home insurance is frequently required by home mortgage loan providers to safeguard their investment in the home. Lenders wish to guarantee that their economic passions are protected in case of any kind of damage to the home. By having a home insurance plan in position, homeowners can meet this demand and secure their investment in the residential property.

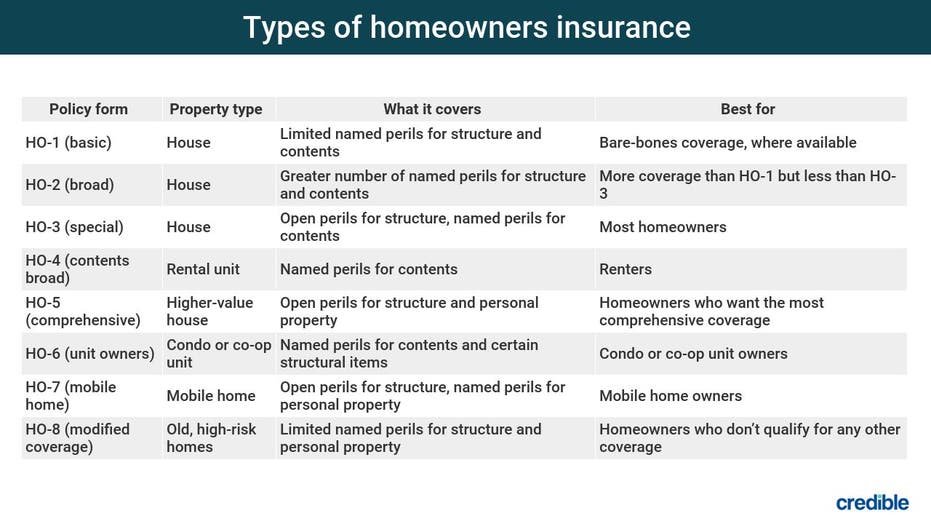

Sorts Of Coverage Available

Given the value of home insurance policy in protecting property owners from unforeseen economic losses, it is vital to comprehend the different sorts of insurance coverage readily available to tailor a policy that suits individual needs and situations. There are a number of crucial sorts of protection used by the majority of home insurance plan. The initial is residence insurance coverage, which shields the framework of the home itself from threats such as fire, criminal damage, and all-natural catastrophes (San Diego Home Insurance). Individual residential property insurance coverage, on the various other hand, safeguards personal belongings within the home, consisting of furniture, electronics, and clothing. Liability coverage is essential for shielding home owners from medical and legal expenses if somebody is harmed on their residential property. If the home ends up being uninhabitable due to a protected loss, extra living expenses insurance coverage can assist cover prices. It is necessary for house owners to thoroughly review and recognize the different sorts of protection readily available to guarantee they have adequate defense for their particular needs.

Elements That Effect Premiums

Variables affecting home insurance coverage premiums can vary based on an array of factors to consider certain to private circumstances. Older homes or residential or commercial properties with outdated electric, plumbing, or find this heating systems might present higher threats for insurance coverage companies, leading to higher costs.

Furthermore, the coverage limits and deductibles picked by the insurance policy holder can impact the costs quantity. Choosing higher insurance coverage limitations or reduced deductibles normally leads to greater premiums. The type of building and construction products made use of in the home, such as timber versus brick, can also influence premiums as particular materials might be a lot more susceptible to damages.

Just How to Select the Right Policy

Choosing the ideal home insurance plan entails careful factor to consider of numerous crucial facets to guarantee detailed insurance coverage tailored to private demands and situations. To start, analyze the value of your home and its contents precisely. Next off, consider the different kinds of protection readily available, such as dwelling protection, individual property protection, responsibility protection, and extra living costs insurance coverage.

Furthermore, assessing the insurance company's online reputation, economic security, client service, and claims procedure is critical. By very carefully examining these aspects, you can choose a home insurance plan that supplies the necessary defense and tranquility of mind.

Benefits of Reliable Home Insurance Coverage

Dependable home insurance supplies a feeling of safety and protection for house owners versus unanticipated events and economic losses. One of the vital benefits of reliable home insurance policy is the assurance that your property will be covered in click over here case of damage or devastation brought on by all-natural calamities such as tornados, floods, or fires. This protection can aid property owners stay clear of birthing the full expense of repairs or rebuilding, supplying assurance and financial stability throughout tough times.

Additionally, trustworthy home insurance plan commonly consist of liability protection, which can secure home owners from legal and medical costs when it comes to accidents on their home. This insurance coverage expands beyond the physical structure of the home to safeguard against claims and cases that might emerge from injuries sustained by visitors.

Furthermore, having trustworthy home insurance coverage can likewise add to a sense of general wellness, understanding that your most considerable financial investment is secured versus different dangers. By paying routine premiums, property owners can reduce the potential financial burden of unexpected events, permitting them to concentrate on appreciating their homes without continuous stress over what might happen.

Verdict

To conclude, protecting a reputable home insurance plan is necessary for protecting your home and possessions from unexpected occasions. By comprehending the types of insurance coverage offered, factors that affect premiums, and just how to choose the appropriate policy, you can guarantee your peace of mind. Counting on a trustworthy home insurance copyright will supply you the benefits of economic protection and protection for your most important property.

Navigating the world of home insurance can be complicated, with numerous protection alternatives, policy elements, and factors to consider to weigh. Comprehending why home insurance policy is vital, the kinds of coverage offered, and just how to choose the best plan can be pivotal in ensuring your most considerable financial investment remains protected.Offered the importance of home insurance coverage in securing homeowners from unforeseen economic losses, it is crucial to comprehend the different kinds of insurance coverage available to tailor a policy that fits specific demands and circumstances. San Diego Home Insurance. There are a number of essential kinds of protection supplied by most home insurance policies.Choosing the ideal home insurance coverage plan involves careful consideration of various key aspects to make certain detailed coverage tailored to individual requirements and circumstances

Report this page